UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨ | ||||||||||||||

| Check the appropriate box: | ||||||||||||||

| ¨ | Preliminary Proxy Statement | |||||||||||||

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||||||||||||

| x | Definitive Proxy Statement | |||||||||||||

| ¨ | Definitive Additional Materials | |||||||||||||

| ¨ | Soliciting Material under §240.14a-12 | |||||||||||||

NIKE, INC.Inc.

(Name of registrant as specified in its charter)

(Name of person(s) filing proxy statement, if other than the registrant)

| Payment of Filing Fee (Check the appropriate box): | ||||||||||||||

| x | No fee required | |||||||||||||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11 | |||||||||||||

| (1) | Title of each class of securities to which transaction applies: | |||||||||||||

| (2) | Aggregate number of securities to which transaction applies: | |||||||||||||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |||||||||||||

| (4) | Proposed maximum aggregate value of transaction: | |||||||||||||

| (5) | Total fee paid: | |||||||||||||

| ¨ | Fee paid previously with preliminary materials. | |||||||||||||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||||||||||||

| (1) | Amount Previously Paid: | |||||||||||||

| (2) | Form, Schedule or Registration Statement No.: | |||||||||||||

| (3) | Filing Party: | |||||||||||||

| (4) | Date Filed: | |||||||||||||

MESSAGE FROM OUR

EXECUTIVE CHAIRMAN

EXECUTIVE CHAIRMAN

To Our Shareholders: At Nike, our passion for sport, innovation, and Over the Looking ahead to We are pleased to invite you to attend the Annual Meeting of Shareholders of NIKE, Inc. to be held virtually on Sincerely, | " | ||||

| |||||

MARK | |||||

| July | |||||

NOTICE OF ANNUAL MEETING

OF SHAREHOLDERS

OF SHAREHOLDERS

TO THE SHAREHOLDERS OF NIKE, INC.

You are cordially invited to the 2023 Annual Meeting of Shareholders (the "Annual Meeting") of NIKE, Inc., an Oregon corporation:

corporation ("NIKE" or the "Company"):

DATE AND TIME: 12, 2023, at | LOCATION: This year's meeting will be a virtual Annual Meeting at www.virtualshareholdermeeting.com/ | ||||

ITEMS OF BUSINESS:

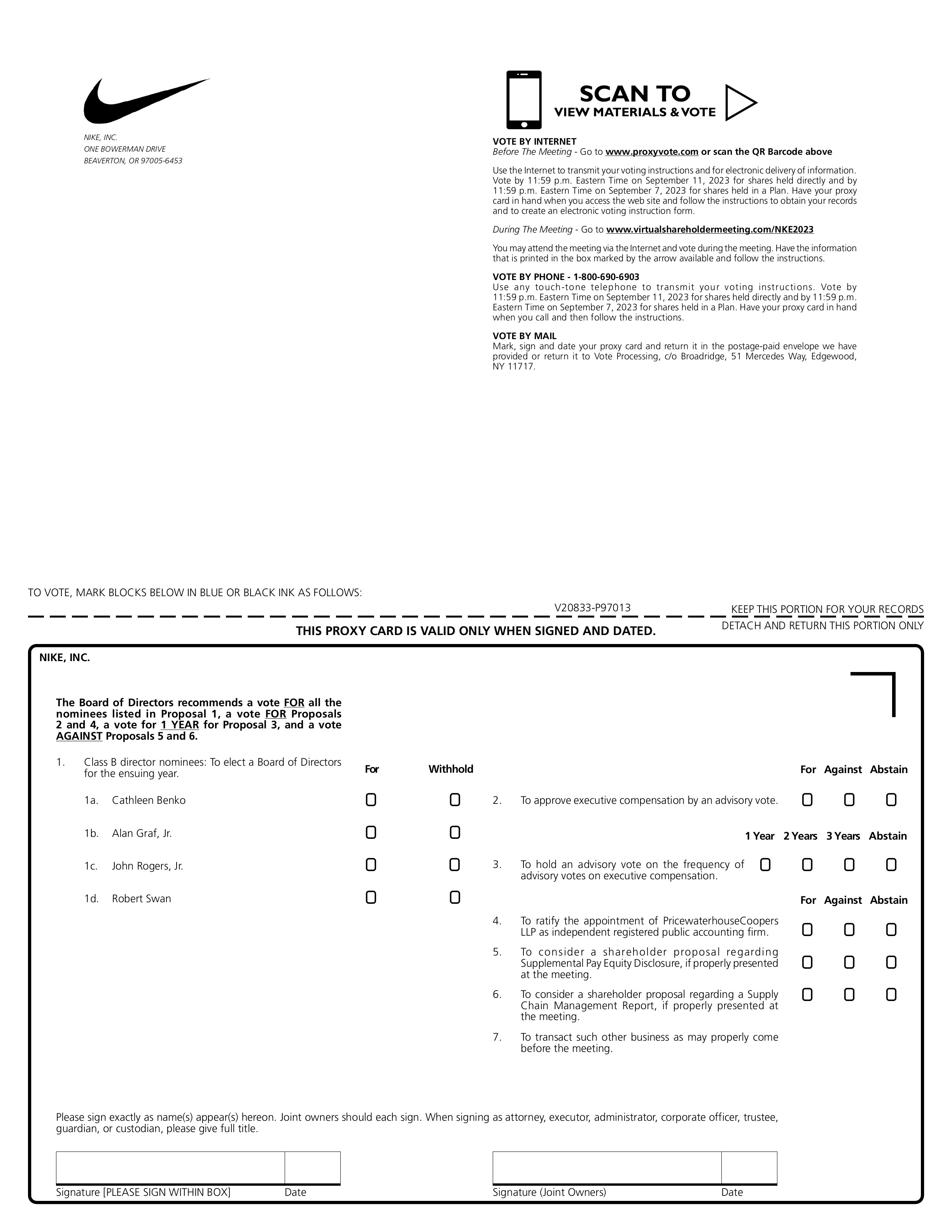

| PROPOSAL | PAGE REFERENCE | ||||||||||

1To elect the | Page | ||||||||||

Class A Will elect nine directors. | Class B Will elect | ||||||||||

| Holders of Class A Stock and holders of Class B Stock will vote together as one class on all other proposals. | |||||||||||

2To approve executive compensation by an advisory vote. | Page | ||||||||||

3To hold an advisory vote on the frequency of advisory votes on executive compensation. | Page 57 | ||||||||||

4To ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm. | Page | ||||||||||

5To consider a shareholder proposal regarding | Page | ||||||||||

6To consider a shareholder proposal regarding a Supply Chain Management Report, if properly presented at the meeting. | Page 63 | ||||||||||

7To transact such other business as may properly come before the meeting. | |||||||||||

By Order of the Board of Directors,

Mary Hunter

Vice President, Corporate Secretary

| Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting of Shareholders To Be Held on September | ||

2023 PROXY STATEMENT 2

TABLE OF CONTENTS

| PAGE | |||||||||

| PROPOSAL 3 | |||||||||

PROPOSAL 5 | |||||||||

| PROPOSAL 6 | |||||||||

3 NIKE, INC.

CORPORATE GOVERNANCE

PROPOSAL 1 ELECTION OF DIRECTORS | |||||||||||

A Ms. Cathleen Benko, Mr. Alan Under Oregon law and our Bylaws, if a quorum of each class of shareholders is present at the Annual Meeting, the nine director nominees who receive the greatest number of votes cast by holders of Class A Stock and the The Bylaws and the Corporate Governance Guidelines of the Company provide that any nominee for director in an uncontested election who receives a greater number of votes "withheld" from Background information on the nominees as of July | |||||||||||

| BOARD RECOMMENDATION | |||||||||||

| The Board of Directors recommends that the Class A Shareholders vote FOR the election of nominees to the Board of Directors |  | The Board of Directors recommends that the Class B Shareholders vote FOR the election of nominees to the Board of Directors | ||||||||

NIKE, INC. BOARD OF DIRECTORS

BOARD OVERVIEW

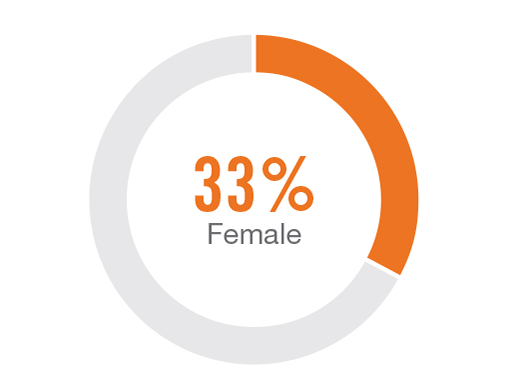

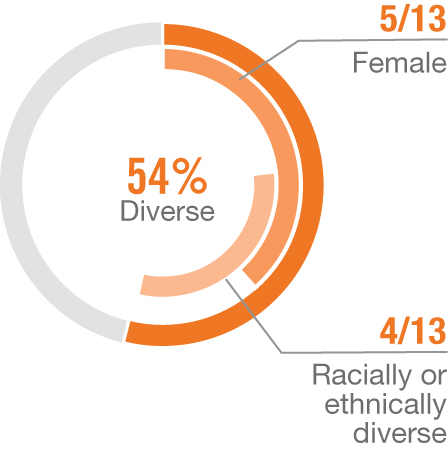

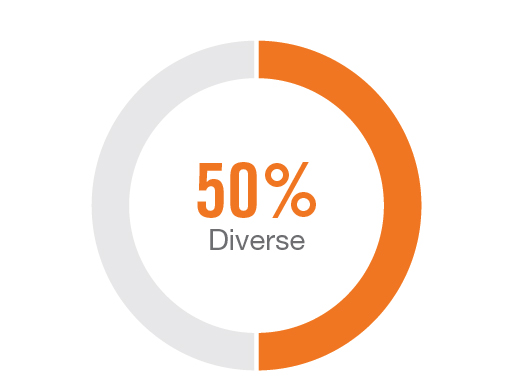

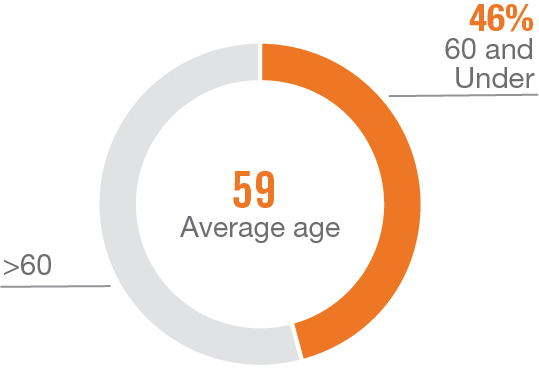

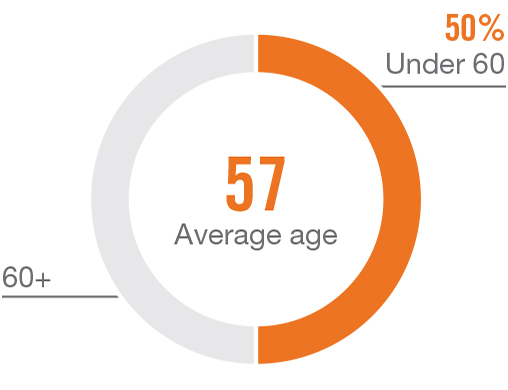

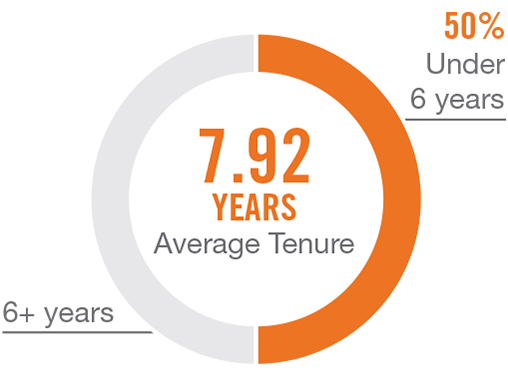

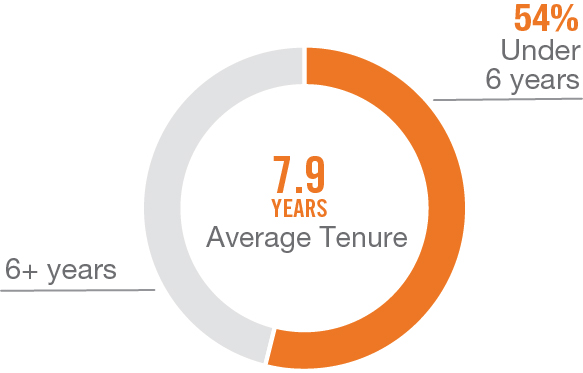

Our Board is currently comprised of twelve13 individuals selected on the basis of numerous criteria, including experience and achievements;achievements, fields of significant knowledge;knowledge, good character;character, sound judgment;judgment, and diversity. We view the effectiveness of our Board both through an individual and collective lens and believe that our Board is optimized to support and guide the Company.

| AGE | TENURE | ||||||||

|   |  |   | ||||||

BOARD SKILLS, EXPERIENCES, AND QUALIFICATIONS

|   |   | |||||||||||||||||||||||||||||||||

DIVERSITY Gender, racial, or ethnic diversity that adds a range of perspectives and expands the | FINANCIAL EXPERTISE Financial expertise assists our Board in overseeing our financial statements, capital structure, and internal controls. | CEO EXPERIENCE CEO experience brings leadership qualifications and skills that help our Board to capably advise, support, and oversee our management team, including regarding our strategy to drive long-term value. | |||||||||||||||||||||||||||||||||

|   |   | |||||||||||||||||||||||||||||||||

INTERNATIONAL International exposure yields an understanding of diverse business environments, economic conditions, and cultural perspectives that informs our global business and strategy and enhances oversight of our multinational operations. | DIGITAL/TECHNOLOGY 6/ Technology experience helps our Board oversee cybersecurity and advise our management team as we seek to enhance the consumer experience and further develop our multi-channel strategy. | RETAIL INDUSTRY Retail experience brings a deep understanding of factors affecting our industry, operations, business needs, and strategic goals. | |||||||||||||||||||||||||||||||||

|   |   |   | ||||||||||||||||||||||||||||||||

MEDIA 2/ Media experience provides the Board with insight about connecting with consumers and other stakeholders in a timely and impactful manner. | ACADEMIA 1/ Academia provides organizational management experience and knowledge of current issues in academia and thought leadership. | HR/TALENT MANAGEMENT HR and talent management experience assists our Board in overseeing executive compensation, succession planning, and employee engagement. | GOVERNANCE Public company board experience provides insight into new and best practices which informs our commitment to excellence in corporate governance. | ||||||||||||||||||||||||||||||||

CORPORATE GOVERNANCE HIGHLIGHTS ü ü Separate ü ü Director nominees selected based on robust qualification standards, including the desire to represent and serve the interests of all shareholders, and a holistic approach to Board composition ü Retirement policy generally requires that directors do not stand for election after reaching the age of 72 | ||

5 NIKE, INC.

NOMINEES FOR ELECTION BY CLASS A SHAREHOLDERS

| AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCT(S) | |||

| 62 | 2018 | Compensation | None | Converse All Star Platform Low Top and Nike AeroLayer Jacket | |||

| SKILLS, EXPERIENCES AND QUALIFICATIONS | ||||||

| DIVERSITY |  | DIGITAL/TECHNOLOGY |  | HR/TALENT MANAGEMENT | ||

| INTERNATIONAL | ||||||

| AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCT(S) | |||

| 59 | 2011 | Compensation | None | Nike Air Force 1 and Nike Air Satin Jacket | |||

| SKILLS, EXPERIENCES AND QUALIFICATIONS | ||||||

| DIVERSITY |  | DIGITAL/TECHNOLOGY |  | MEDIA | ||

| INTERNATIONAL | ||||||

| AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCT(S) | |||

| 61 | 2005 | Audit & Finance | Splunk, Inc. | Nike React and Nike SFB Boots | |||

| SKILLS, EXPERIENCES AND QUALIFICATIONS | ||||||

| FINANCIAL EXPERTISE |  | DIGITAL/TECHNOLOGY |  | GOVERNANCE | ||

| INTERNATIONAL | ||||||

TIMOTHY D. COOK, LEAD INDEPENDENT DIRECTOR

| AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCT(S) | AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCTS | |||||||||||||||||||||

| 59 | 2005 | Compensation, Chair | Apple Inc. | Nike Epic React and Nike Flex | ||||||||||||||||||||||||||

| 62 | 62 | 2005 | Compensation, Chair | Apple Inc. | Nike Air Max 270 and Nike Free Metcon | |||||||||||||||||||||||||

|  | SKILLS, EXPERIENCES AND QUALIFICATIONS |  | SKILLS, EXPERIENCES AND QUALIFICATIONS | ||||||||||||||||||||||||||

| FINANCIAL EXPERTISE |  | DIGITAL/TECHNOLOGY |  | HR/TALENT MANAGEMENT |  | FINANCIAL EXPERTISE |  | DIGITAL/TECHNOLOGY |  | HR/TALENT MANAGEMENT | |||||||||||||||||||

| CEO EXPERIENCE |  | RETAIL INDUSTRY |  | GOVERNANCE |  | CEO EXPERIENCE |  | RETAIL INDUSTRY |  | GOVERNANCE | |||||||||||||||||||

| INTERNATIONAL |  | INTERNATIONAL | |||||||||||||||||||||||||||

Mr. Cook is the Company’sCompany's Lead Independent Director and is the Chief Executive Officer of Apple Inc. ("Apple").

•Mr. Cook joined Apple in March 1998 as Senior Vice President of Worldwide Operations and also served as its Executive Vice President, Worldwide Sales and Operations and Chief Operating Officer.

•Mr. Cook was Vice President, Corporate Materials for Compaq Computer Corporation from 1997 to 1998.

•Previous to his work at Compaq, Mr. Cook served in the positions of Senior Vice President Fulfillment and Chief Operating Officer of the Reseller Division at Intelligent Electronics from 1994 to 1997.

•Mr. Cook also worked for International Business Machines Corporation from 1983 to 1994, most recently as Director of North American Fulfillment.

Mr. Cook is a member of the Board of Directors of Apple. In addition to this public company board service, he is also a member of the Board of Directors of the National Football Foundation and Duke University Board of Trustees.

JOHN J. DONAHOE II

| AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCT(S) | AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCTS | |||||||||||||||||||||

| 60 | 2014 | Executive | PayPal Holdings, Inc. | Nike Phantom Epic React and Jordan Jumpman Hoodie | ||||||||||||||||||||||||||

| 63 | 63 | 2014 | Executive | PayPal Holdings, Inc. | Nike Invincible 3 and Nike Waffle One | |||||||||||||||||||||||||

|  | SKILLS, EXPERIENCES AND QUALIFICATIONS | SKILLS, EXPERIENCES AND QUALIFICATIONS | |||||||||||||||||||||||||||

| FINANCIAL EXPERTISE |  | DIGITAL/TECHNOLOGY |  | HR/TALENT MANAGEMENT |  | ||||||||||||||||||||||||

| FINANCIAL EXPERTISE |  | DIGITAL/TECHNOLOGY |  | HR/TALENT MANAGEMENT | |||||||||||||||||||||||||

| CEO EXPERIENCE |  | RETAIL INDUSTRY |  | GOVERNANCE | |||||||||||||||||||||||||

| CEO EXPERIENCE |  | RETAIL INDUSTRY |  | GOVERNANCE | |||||||||||||||||||||||||

| INTERNATIONAL | |||||||||||||||||||||||||||||

| INTERNATIONAL | |||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||

Mr. Donahoe is President and Chief Executive Officer of NIKE, Inc. and has been a director since 2014.

•From 2017 to 2019, Mr. Donahoe served as President and Chief Executive Officer of ServiceNow, Inc. ("ServiceNow"), provider of enterprise cloud computing services for global enterprises.

•From 2008 to 2015, Mr. Donahoe served as President and Chief Executive Officer of eBay, Inc. ("eBay"), provider of the global eBay.com online marketplace and PayPal digital payments platform.

•Mr. Donahoe joined eBay in 2005 as President of eBay Marketplaces, responsible for eBay’seBay's global e-Commerce businesses.

•Prior to joining eBay, Mr. Donahoe was the Chief Executive Officer and Worldwide Managing Director of Bain & Company from 1999 to 2005, and a Managing Director from 1992 to 1999.

Mr. Donahoe is Chairman and a member of the Board of Directors of PayPal Holdings, Inc. In addition to this public company board service, he also serves on the Board of Trustees for The Bridgespan Group. Mr. Donahoe served on the Board of Directors of Intel Corporation from March 2009 to May 2017 and ServiceNow from March 2017 to June 2020.

THASUNDA B. DUCKETT

| AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCTS | |||||||||||||||||||

| 49 | 2019 | Corporate Responsibility, Sustainability & Governance | None | Nike Air Force 1 and Air Jordan | |||||||||||||||||||

| SKILLS, EXPERIENCES AND QUALIFICATIONS | ||||||||||||||||||||||

| DIVERSITY |  | FINANCIAL EXPERTISE |  | CEO EXPERIENCE | ||||||||||||||||||

| RETAIL INDUSTRY |  | HR/TALENT MANAGEMENT | ||||||||||||||||||||

| AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCT(S) | |||

| 47 | 2019 | Corporate Responsibility, Sustainability & Governance | None | Air Jordans, Nike Air Force 1, and Nike Air Max 270 | |||

| SKILLS, EXPERIENCES AND QUALIFICATIONS | ||||||

| DIVERSITY |  | FINANCIAL EXPERTISE |  | CEO EXPERIENCE | ||

| RETAIL INDUSTRY |  | HR/TALENT MANAGEMENT | ||||

Ms. Duckett is President and Chief Executive Officer of the Teachers Insurance and Annuity Association of America ("TIAA"), a leading provider of financial services in the academic, research, medical, cultural, and governmental fields.

•Prior to joining TIAA, Ms. Duckett was Chief Executive Officer of Chase Consumer Banking at JPMorgan Chase & Co. ("JPMorgan Chase"). from 2016 to 2021. Before that appointment, Ms. Duckett was appointed to various management positions at JPMorgan Chase, including:

•From 2013 to 2016, Ms. Duckett served as the Chief Executive Officer of Chase Auto Finance.Finance, and

•From 2004 to 2013, Ms. Duckett held multiple management and consumer lending roles with JPMorgan Chase.roles.

•Prior to joining JPMorgan Chase, Ms. Duckett was Director of Emerging Markets at the Federal National Mortgage Association, or Fannie Mae.

Ms. Duckett is chairChair of the Otis and Rosie Brown Foundation and serves on the Board of Directors of Brex, National Medal of Honor Museum, and the Robert F. Kennedy Human Rights. She also serves on the Board of Trustees for Sesame Workshop.

2023 PROXY STATEMENT 8

MÓNICA GIL

| AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCTS | |||||||||||||||||||

| 51 | 2022 | Compensation | None | Air Jordan 1, Nike Blazer Low, and Nike Vaporfly 2 | |||||||||||||||||||

| SKILLS, EXPERIENCES AND QUALIFICATIONS | ||||||||||||||||||||||

| DIVERSITY |  | INTERNATIONAL |  | MEDIA | ||||||||||||||||||

| HR/TALENT MANAGEMENT | ||||||||||||||||||||||

Ms. Gil is Chief Administrative and Marketing Officer, NBCUniversal Telemundo Enterprises ("Telemundo") for Comcast Corp.

•Prior to her current role, Ms. Gil served as Chief Marketing Officer, Telemundo from 2018 until 2020, and as Executive Vice President, Telemundo, managing Communications and Corporate Affairs and Human Resources from 2017 until 2018.

•Prior to joining Telemundo, Ms. Gil served as Senior Vice President and General Manager, Multicultural Growth and Strategy of the Nielsen Company ("Nielsen") from 2014 until 2017.

•Ms. Gil joined Nielsen in 2005 as Vice President, Communications and was subsequently promoted in 2009 to Senior Vice President, Public Affairs and Government Relations.

•Previously, Ms. Gil served as Senior Vice President for Greer, Margolis, Mitchell and Burns from 2004 until 2005.

•She also served as Director of Public Affairs and Community Outreach for Telemundo Communications Group, Inc., Los Angeles, from 2001 to 2004.

Ms. Gil is a member of the Board of Directors of the Children’s Learning CenterNational Women's History Museum and Welcome Tech, Inc.

9 NIKE, INC.

MARIA HENRY

| AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCTS | |||||||||||||||||||

| 56 | 2023 | Audit & Finance | General Mills, Inc. | Nike Invincible 2 and Nike Epic Luxe leggings | |||||||||||||||||||

| SKILLS, EXPERIENCES AND QUALIFICATIONS | ||||||||||||||||||||||

| DIVERSITY |  | FINANCIAL EXPERTISE |  | INTERNATIONAL | ||||||||||||||||||

| DIGITAL/TECHNOLOGY |  | RETAIL INDUSTRY |  | GOVERNANCE | ||||||||||||||||||

Ms. Henry is the former Chief Financial Officer of Fairfax County. AdditionallyKimberly-Clark Corporation ("Kimberly-Clark"), a position she held from 2015 to April 2022 and served as Executive Vice President and Senior Advisor from April 2022 until her retirement in September 2022.

•Prior to joining Kimberly-Clark, she was Executive Vice President and Chief Financial Officer of The Hillshire Brands Company, formerly known as Sara Lee Corporation ("Sara Lee"), from 2012 to 2014. Ms. Henry was the Chief Financial Officer of Sara Lee's North American Retail and Foodservice business from 2011 to 2012.

•Prior to Sara Lee, she held various senior leadership positions in finance and strategy in three portfolio companies of Clayton, Dubilier, & Rice, most recently as Executive Vice President and Chief Financial Officer of Culligan International. Ms. Henry also held senior finance roles in several technology companies, and she began her career at General Electric.

Ms. Henry is a member of the Board of Directors of General Mills, Inc.

2023 PROXY STATEMENT 10

PETER HENRY

| AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCTS | |||||||||||||||||||

| 53 | 2018 | Audit & Finance | Citigroup Inc. | Nike Epic React | |||||||||||||||||||

| SKILLS, EXPERIENCES AND QUALIFICATIONS | ||||||||||||||||||||||

| DIVERSITY |  | INTERNATIONAL |  | GOVERNANCE | ||||||||||||||||||

| FINANCIAL EXPERTISE |  | ACADEMIA | ||||||||||||||||||||

Dr. Henry is Class of 1984 Senior Fellow at Stanford University's Hoover Institution, Senior Fellow at Stanford's Freeman Spogli Institute for International Studies, and Dean Emeritus of New York University's Leonard N. Stern School of Business ("Stern").

•Dr. Henry assumed the Deanship of Stern in January 2010 and served through December 2017.

•Prior to joining Stern, Dr. Henry was the Konosuke Matsushita Professor of International Economics at the Stanford University Graduate School of Business.

•In June 2009, President Obama appointed Dr. Henry to the President's Commission on White House Fellowships.

•In 2008, Dr. Henry led Barack Obama's Presidential Transition Team in its review of international lending agencies such as the IMF and the World Bank.

Dr. Henry is a member of the Board of Directors of Citigroup Inc. In addition to this public company board service, he also serves on the Board of The Robert F. Kennedy Human Rights Foundation.Directors of the National Bureau of Economic Research and the Economic Club of New York and serves on the Advisory Board for Protiviti and Biospring Partners. Dr. Henry is a member of the Council of Foreign Relations and the Economic Advisory Panel of the Federal Reserve Bank of New York. Dr. Henry served on the Board of Directors of General Electric from July 2016 until April 2018 and Kraft Foods Group, Inc. and its predecessor, Kraft Foods Inc., from May 2011 until July 2015.

TRAVIS A. KNIGHT

| AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCT(S) | AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCTS | |||||||||||||||||||||

| 46 | 2015 | Executive | None | Nike Air Zoom Pegasus | ||||||||||||||||||||||||||

| 49 | 49 | 2015 | Executive | None | Nike Pegasus | |||||||||||||||||||||||||

|  | SKILLS, EXPERIENCES AND QUALIFICATIONS |  | SKILLS, EXPERIENCES AND QUALIFICATIONS | ||||||||||||||||||||||||||

| FINANCIAL EXPERTISE |  | CEO EXPERIENCE |  | MEDIA |  | FINANCIAL EXPERTISE |  | CEO EXPERIENCE |  | MEDIA | |||||||||||||||||||

Mr. Knight is the President and Chief Executive Officer of the animation studio, LAIKA, LLC ("LAIKA"), which specializes in feature-length films.

•Mr. Knight has been involved in all principal creative and business decisions at LAIKA since its founding in 2003, serving in successive management positions as Lead Animator, Vice President of Animation, and then as President and Chief Executive Officer in 2009.

•Mr. Knight was Producer and Director of the feature film Kubo and the Two Strings (2017) which was nominated for an Academy Award and winner of the BAFTA award for Best Animated Film.

•Mr. Knight has served as Producer and Lead Animator on Academy Award-nominated feature-length films The Boxtrolls (2014) and ParaNorman (2012), for which he won an Annie Award for Outstanding Achievement in Character Animation, and Lead Animator for Coraline (2009).

•Prior to his work at LAIKA, Mr. Knight held various animation positions at Will Vinton Studios from 1998 to 2002, and as a stop-motion animator for television series, commercials, and network promotions. He has been recognized for his work on the Emmy Award-winning stop-motion animated television series The PJs.

Mr. Knight serves on the Board of Directors of LAIKA. He is the son of NIKE’sNIKE's co-founder, Mr. Philip Knight, who currently serves as Chairman Emeritus. In addition to his skills and qualifications described above, Mr. Travis Knight was selected to serve on the Board because he has a significant role in the management of the Class A Stock owned by Swoosh, LLC, strengthening the alignment of the Board with the interests of NIKE shareholders.

MARK G. PARKER, EXECUTIVE CHAIRMAN OF THE BOARD

| AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCT | AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCTS | |||||||||||||||||||||

| 64 | 2006 | Executive, Chair | The Walt Disney Company | Still can't pick just one | ||||||||||||||||||||||||||

| 67 | 67 | 2006 | Executive, Chair | The Walt Disney Company | Nike Pegasus, Nike Air Max, and Nike React Infinity Run | |||||||||||||||||||||||||

|  | SKILLS, EXPERIENCES AND QUALIFICATIONS |  | SKILLS, EXPERIENCES AND QUALIFICATIONS | ||||||||||||||||||||||||||

| FINANCIAL EXPERTISE |  | INTERNATIONAL |  | HR/TALENT MANAGEMENT |  | FINANCIAL EXPERTISE |  | INTERNATIONAL |  | HR/TALENT MANAGEMENT | |||||||||||||||||||

| CEO EXPERIENCE |  | RETAIL INDUSTRY |  | GOVERNANCE |  | CEO EXPERIENCE |  | RETAIL INDUSTRY |  | GOVERNANCE | |||||||||||||||||||

Mr. Parker is Executive Chairman of the Board of Directors of the Company. He served as President and Chief Executive Officer of the Company from 2006 to January 2020.

•Mr. Parker has been employed by NIKE since 1979 with primary responsibilities in product research, design and development, marketing, and brand management.

•Mr. Parker was appointed:

•President and Chief Executive Officer in 2006,

•President of the NIKE Brand in 2001,

•Vice President of Global Footwear in 1998,

•General Manager in 1993,

•Corporate Vice President in 1989, and

•Divisional Vice President in charge of product development in 1987.

Mr. Parker is a memberChairman of the Board of Directors of The Walt Disney Company. In addition to his skills and qualifications described above, Mr. Parker was selected to serve on the Board because the experience gained while serving as the Company's Chief Executive Officer makes his position as Executive Chairman of the Board instrumental.

| AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCT(S) | |||

| 62 | 2018 | Corporate Responsibility, Sustainability & Governance | McDonald’s Corporation and The New York Times Company | Nike KD and Nike LeBron Basketball Shoes | |||

| SKILLS, EXPERIENCES AND QUALIFICATIONS | ||||||

| DIVERSITY |  | CEO EXPERIENCE |  | GOVERNANCE | ||

| FINANCIAL EXPERTISE | ||||||

| AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCTS | |||||||||||||||||||

| 51 | 2014 | Corporate Responsibility, Sustainability & Governance, Chair | None | Air Jordan 1 Low, Nike Air Max 97, Nike Dunk High, Nike Air Force 1, Nike Yoga Luxe, and Nike Dri-Fit ADV Epic Luxe | |||||||||||||||||||

| SKILLS, EXPERIENCES AND QUALIFICATIONS | ||||||||||||||||||||||

| DIVERSITY |  | INTERNATIONAL |  | HR/TALENT MANAGEMENT | ||||||||||||||||||

| FINANCIAL EXPERTISE |  | DIGITAL/TECHNOLOGY |  | GOVERNANCE | ||||||||||||||||||

| CEO EXPERIENCE |  | RETAIL INDUSTRY | ||||||||||||||||||||

Ms. Peluso is Chairman, Co-CEOExecutive Vice President and Chief InvestmentCustomer Officer at CVS Health and Co-President, Pharmacy and Consumer Wellness, responsible for leading the front store retail business, transforming the enterprise's consumer experience, and leveraging marketing to ensure CVS Health becomes the leading health solutions company for consumers.

•Prior to joining CVS Health, Ms. Peluso was Senior Vice President, Digital Sales and Chief Marketing Officer at IBM from 2016 to 2021. She oversaw marketing and brand strategy and execution, digital sales, and the commercial business, globally. She was also responsible for the company's client experience.

•Prior to her work at IBM, Ms. Peluso served as Chief Executive Officer of Ariel Investments, LLC, a privately-held money management firm he foundedonline shopping destination Gilt Groupe, Inc. ("Gilt") from 2013 until its sale to Hudson's Bay Company in 1983, which serves individualFebruary 2016 and institutional investors through its mutual funds and separate accounts.was on Gilt's Board of Directors from 2009 to 2016.

•From 2002 to 2009, Ms. Peluso held senior management positions at Travelocity.com LP ("Travelocity"), being appointed Chief Operating Officer in March 2003, and more recently, joined the Barack Obama Foundation’s Board of Directors.President and Chief Executive Officer in December 2003.

Ms. Peluso is a member of the Board of Directors of McDonald’s Corporation and The New York Times Company. In addition to this public company board service, he also serves as trustee ofat the University of Chicago, the Robert F. Kennedy Center for Justice and Human Rights, the National Association of Basketball Coaches (NABC) Foundation, Inc.,Ad Council and is a life trusteeon the Executive Council of the Chicago Symphony Orchestra. Mr. Rogers served on the Board of Directors of Exelon Corporation from October 2000 until April 2019.the Association of National Advertisers.

| BOARD RECOMMENDATION | |||||

| The Board of Directors recommends that the Class A Shareholders vote FOR the election of the nominees above to the Board of Directors. | ||||

NOMINEES FOR ELECTION BY CLASS B SHAREHOLDERS

CATHLEEN BENKO

| AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCTS | |||||||||||||||||||

| 65 | 2018 | Compensation | SolarWinds Corporation | VaporMax | |||||||||||||||||||

| SKILLS, EXPERIENCES AND QUALIFICATIONS | ||||||||||||||||||||||

| DIVERSITY |  | INTERNATIONAL |  | HR/TALENT MANAGEMENT | ||||||||||||||||||

| FINANCIAL EXPERTISE |  | DIGITAL/TECHNOLOGY | ||||||||||||||||||||

Ms. Benko is a former Vice Chairman and Managing Principal of Deloitte LLP ("Deloitte"), an organization that, through its subsidiaries and network of member firms, provides audit, consulting, tax, and advisory services to clients globally. During her nearly 30-year career with Deloitte, Ms. Benko held many leadership roles, several concurrent with her appointment as Vice Chairman and Managing Principal in 2011.

•From 2015 to 2018, Ms. Benko served as Senior Partner working within the firm's "Digital Giants" practice where she was the senior advisory partner for several digital-native companies.

•From 2010 to 2014, Ms. Benko served as Chief Digital, Brand, and Communications Officer.

•Previous to her role as Chief Digital, Brand, and Communications Officer, Ms. Benko held multiple technology and talent management roles, including serving as the company's first Vice Chairman and Chief Talent Officer from 2006 to 2010, its Chief Inclusion Officer from 2008 to 2010, and as Managing Principal, Initiative for the Retention and Advancement of Women, from 2003 to 2009.

•Ms. Benko led Deloitte's technology sector from 2003 to 2007 and was previously Deloitte's first Global e-Business Leader, a position she held from 1998 to 2002.

Ms. Benko is a member of the Board of Directors of SolarWinds Corporation. In addition to this public company board service, she also holds board positions at nonprofits Stanford Institute for Research in the Social Sciences, the International Women's Forum, Santa Clara University's Markkula Center of Applied Ethics, Life Skills for Soldiers, and the National Association of Corporate Directors. She is also on the board of WorkBoard, a privately-held company. Ms. Benko is chair of Harvard Business School/NC's Advisory Council.

15 NIKE, INC.

ALAN B. GRAF, JR.

| AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCT(S) | AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCTS | |||||||||||||||||||||

| 66 | 2002 | Audit & Finance, Chair | Mid-America Apartment Communities, Inc. | Nike Air Max 270, Nike Air Max, and Nike Polos | ||||||||||||||||||||||||||

| 69 | 69 | 2002 | Audit & Finance, Chair | Mid-America Apartment Communities, Inc. | Nike Invincible 3 and Nike Dri-Fit Apparel | |||||||||||||||||||||||||

|  | SKILLS, EXPERIENCES AND QUALIFICATIONS |  | SKILLS, EXPERIENCES AND QUALIFICATIONS | ||||||||||||||||||||||||||

| FINANCIAL EXPERTISE |  | INTERNATIONAL |  | GOVERNANCE |  | FINANCIAL EXPERTISE |  | INTERNATIONAL |  | GOVERNANCE | |||||||||||||||||||

Mr. Graf is the former Executive Vice President and Chief Financial Officer of FedEx Corporation ("FedEx"), a position he has held sincefrom 1998 and is a member of FedEx’s Executive Committee.until his retirement in December 2020.

•Mr. Graf joined FedEx in 1980 and was Senior Vice President and Chief Financial Officer for FedEx Express, FedEx’sFedEx's predecessor, from 1991 to 1998.

Mr. Graf is a member of the Board of Directors of Mid-America Apartment Communities, Inc. In addition to this public company board service, he is also a director of the Indiana University FoundationFoundation. Mr. Graf previously served on the Board of Directors of Kimball International Inc., Storage USA, Inc., and Arkwright Mutual Insurance Co.

2023 PROXY STATEMENT 16

JOHN ROGERS, JR.

| AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCTS | |||||||||||||||||||

| 65 | 2018 | Corporate Responsibility, Sustainability & Governance | The New York Times Company and Ryan Specialty Group Holdings, Inc. | Nike KD and Nike LeBron Basketball Shoes | |||||||||||||||||||

| SKILLS, EXPERIENCES AND QUALIFICATIONS | ||||||||||||||||||||||

| DIVERSITY |  | CEO EXPERIENCE |  | GOVERNANCE | ||||||||||||||||||

| FINANCIAL EXPERTISE | ||||||||||||||||||||||

Mr. Rogers is Chairman, Co-Chief Executive Officer, and Chief Investment Officer of Ariel Investments, LLC, a privately-held money management firm he founded in 1983, which serves individual and institutional investors through its mutual funds and separate accounts. Mr. Rogers is a Trustee of Ariel Investment Trust, the University of Memphis. While Mr. Mr. Graf has announced his intention to retire from his position as CFO of FedEx, NIKE stands behind his seat on our Board and believes that he has provided, and will continue to provide, exemplary guidance and advice, and gives the necessary attention and dedication to his role as a Board member and as a committee chair.

| AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCT(S) | |||

| 50 | 2018 | Audit & Finance | Citigroup Inc. | Nike Epic React | |||

| SKILLS, EXPERIENCES AND QUALIFICATIONS | ||||||

| DIVERSITY |  | INTERNATIONAL |  | GOVERNANCE | ||

| FINANCIAL EXPERTISE |  | ACADEMIA | ||||

•In 2008, Mr. Henry led Barack Obama’sRogers was awarded Princeton University's highest honor, the Woodrow Wilson Award, presented each year to the alumnus whose career embodies a commitment to national service.

•Mr. Rogers served as co-chair for the Presidential Transition Team in its review of international lending agencies such as the IMF and the World Bank.Inaugural Committee 2009.

Mr. HenryRogers is a member of the Board of Directors of CitigroupThe New York Times Company and Ryan Specialty Group Holdings, Inc. In addition to this public company board service, he also serves onas trustee of the University of Chicago; a member of the Board of Directors of the National Bureau of Economic ResearchBarack Obama Foundation, the Robert F. Kennedy Human Rights, and the Economic ClubNational Association of New YorkBasketball Coaches (NABC) Foundation, Inc.; and serves on the Advisory Board for Protiviti. Mr. Henry is a memberlife trustee of the Council of Foreign Relations and the Economic Advisory Panel of the Federal Reserve Bank of New York.Chicago Symphony Orchestra. Mr. HenryRogers served on the Board of Directors of General ElectricMcDonald's Corporation from JulyMay 2003 until May 2023 and Exelon Corporation from October 2000 until April 2019.

17 NIKE, INC.

ROBERT SWAN

| AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCTS | |||||||||||||||||||

| 63 | 2022 | Audit & Finance | GoTo Group | Nike Pegasus and Air Jordan | |||||||||||||||||||

| SKILLS, EXPERIENCES AND QUALIFICATIONS | ||||||||||||||||||||||

| FINANCIAL EXPERTISE |  | DIGITAL/TECHNOLOGY |  | HR/TALENT MANAGEMENT | ||||||||||||||||||

| CEO EXPERIENCE |  | RETAIL INDUSTRY |  | GOVERNANCE | ||||||||||||||||||

| INTERNATIONAL | ||||||||||||||||||||||

Mr. Swan has been an Operating Partner at Andreessen Horowitz since 2021.

•Prior to his current role, Mr. Swan served as the Chief Executive Officer and a member of the Board of Directors of Intel Corp. ("Intel") from 2019 to 2021. Before that appointment, he was appointed to various management positions at Intel, including:

•Interim Chief Executive Officer and Chief Financial Officer from 2018 until 2019 and Chief Financial Officer from 2016 until April 2018 and Kraft Foods Group, Inc. and its predecessor, Kraft Foods Inc.,2019.

•Prior to joining Intel, Mr. Swan served as Operating Partner at General Atlantic LLC, a private equity firm, from May 2011 until July 2015.2015 to 2016.

| AGE | DIRECTOR SINCE | COMMITTEE | OTHER CURRENT PUBLIC DIRECTORSHIPS | FAVORITE NIKE PRODUCT(S) | |||

| 48 | 2014 | Corporate Responsibility, Sustainability & Governance, Chair | None | Nike React Infinity Run, Nike Air Satin Jacket, and Nike Air Max Tailwind IV | |||

| SKILLS, EXPERIENCES AND QUALIFICATIONS | ||||||

| DIVERSITY |  | INTERNATIONAL |  | HR/TALENT MANAGEMENT | ||

| FINANCIAL EXPERTISE |  | DIGITAL/TECHNOLOGY |  | GOVERNANCE | ||

| CEO EXPERIENCE |  | RETAIL INDUSTRY | ||||

Mr. Swan is a member of the Board of Commissioners of GoTo Group. In addition to Hudson’s Bay Company in February 2016, and was on Gilt’sthis public company board service, he is also a member of the Board of Directors from 2009 to 2016.

| BOARD RECOMMENDATION | |||||

| The Board of Directors recommends that the Class B Shareholders vote FOR the election of the nominees above to the Board of Directors. | ||||

INDIVIDUAL BOARD SKILLS MATRIX

| EXPERIENCE, EXPERTISE, OR ATTRIBUTES | BENKO | COOK | DONAHOE | DUCKETT | GIL | GRAF | M HENRY | P HENRY | KNIGHT | PARKER | PELUSO | ROGERS | SWAN | ||||||||||||||||||||||||||||||||||||||

| DIVERSITY Gender, racial, or ethnic diversity that adds a range of perspectives and expands the | ü | ü | ü | ü | ü | ü | ü | |||||||||||||||||||||||||||||||||||||||||||

| FINANCIAL EXPERTISE Financial expertise assists our Board in overseeing our financial statements, capital structure, and internal controls. | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ||||||||||||||||||||||||||||||||||||||

| CEO EXPERIENCE CEO experience brings leadership qualifications and skills that help our Board to capably advise, support, and oversee our management team, including regarding our strategy to drive long-term value. | ü | ü | ü | ü | ü | ü | ü | ü | ||||||||||||||||||||||||||||||||||||||||||

| INTERNATIONAL International exposure yields an understanding of diverse business environments, economic conditions, and cultural perspectives that informs our global business and strategy and enhances oversight of our multinational operations. | ü | ü | ü | ü | ü | ü | ü | ü | ü | ü | ||||||||||||||||||||||||||||||||||||||||

| DIGITAL/TECHNOLOGY Technology experience helps our Board oversee cybersecurity and advise our management team as we seek to enhance the consumer experience and further develop our multi-channel strategy. | ü | ü | ü | ü | ü | ü | ||||||||||||||||||||||||||||||||||||||||||||

| RETAIL INDUSTRY Retail experience brings a deep understanding of factors affecting our industry, operations, business needs, and strategic goals. | ü | ü | ü | ü | ü | ü | ü | |||||||||||||||||||||||||||||||||||||||||||

| MEDIA Media experience provides the Board with insight about connecting with consumers and other stakeholders in a timely and impactful manner. | ü | ü | ||||||||||||||||||||||||||||||||||||||||||||||||

| ACADEMIA Academia provides organizational management experience and knowledge of current issues in academia and thought leadership. | ü | |||||||||||||||||||||||||||||||||||||||||||||||||

| HR/TALENT MANAGEMENT HR and talent management experience assists our Board in overseeing executive compensation, succession planning, and employee engagement. | ü | ü | ü | ü | ü | ü | ü | ü | ||||||||||||||||||||||||||||||||||||||||||

| GOVERNANCE Public company board experience provides insight into new and best practices which informs our commitment to excellence in corporate governance. | ü | ü | ü | ü | ü | ü | ü | ü | ü | |||||||||||||||||||||||||||||||||||||||||

DIRECTOR NOMINATIONS

The Board of Directors takes an "evergreen" approach to Board refreshment, cultivating relationships with top talent on an ongoing basis. The Corporate Responsibility, Sustainability & Governance Committee identifies potential director candidates through a variety of means, including recommendations from members of the Corporate Responsibility, Sustainability & Governance Committee or the Board, suggestions from Company management, and shareholder recommendations. The committee also may, in its discretion, engage director search firms to identify candidates. Shareholders may recommend director candidates for consideration by the Corporate Responsibility, Sustainability & Governance Committee by submitting a written recommendation to the committee, c/o Ann M. Miller, Vice President, Corporate Secretary, and Chief Ethics & Compliance Officer, NIKE, Inc., One Bowerman Drive, Beaverton, Oregon 97005-6453. The recommendation should include the candidate’scandidate's name, age, qualifications (including principal occupation and employment history), and written consent to be named as a nominee in the Company’sCompany's proxy statement and to serve as a director, if elected.

The Board of Directors has adopted qualification standards for the selection of non-management nominees for director, which can be found at our corporate website: http://investors.nike.com. As provided in these standards and the Company’sCompany's corporate governance guidelines, nominees for director are selected on the basis of, among other things, distinguished business experience or other non-business achievements; education; significant knowledge of international business, finance, marketing, technology, human resources, diversity, &equity, and inclusion, law, or other fields which are complementary to, and balance the knowledge of, other Board members; a desire to represent and serve the diverse interests of all stakeholders;shareholders; independence; good character; ethics; sound judgment; diversity; and ability to devote substantial time to discharge Board responsibilities.

The Corporate Responsibility, Sustainability & Governance Committee identifies qualified potential candidates without regard to their age, gender, race, national origin, sexual orientation, or religion. While the Board has no policy regarding Board member diversity, the Corporate Responsibility, Sustainability & Governance Committee considers and discusses diversity in selecting nominees for director and in the re-nomination of an incumbent director. The committee views diversity broadly to include, among other things, differences in backgrounds, qualifications, experiences, viewpoint, geographic location, education, skills and expertise (including financial, accounting, compliance, corporate social responsibility, public policy, cybersecurity, or other expertise relevant to service on the Board), professional and industry experience, and personal characteristics (including gender, ethnicity/race, and sexual orientation). The Board believes that a variety and balance of perspectives on the Board results in more thoughtful and robust deliberations, and ultimately, better decisions.

In considering the re-nomination of an incumbent director, the Corporate Responsibility, Sustainability & Governance Committee reviews the director’sdirector's overall service to the Company during his or her term, including the number of meetings attended, level of participation, and quality of performance, as well as any special skills, experience, or diversity that such director brings to the Board. All potential new director candidates, whether recommended by shareholders or identified by other means, are initially screened by the Chair of the Corporate Responsibility, Sustainability & Governance Committee, who may seek additional information about the background and qualifications of the candidate, and who may determine that a candidate does not have qualifications that merit further consideration by the full committee. With respect to new director candidates who pass the initial screening, the Corporate Responsibility, Sustainability & Governance Committee meets to discuss and consider each candidate’scandidate's qualifications and potential contributions to the Board, and determines by majority vote whether to recommend such candidatescandidate to the Board. The final decision to either appoint a candidate to fill a vacancy between annual meetings or include a candidate on the slate of nominees proposed at an annual meeting is made by the Board.

It is the general policy of the Board that directors will not stand for re‑election after reaching the age of 72.

DIRECTOR INDEPENDENCE

Pursuant to New York Stock Exchange ("NYSE") listing rules, in order for a director to qualify as "independent", the Board of Directors must affirmatively determine that the director has no material relationship with the Company that would impair the director’sdirector's independence. The Board affirmatively determined that commercial or charitable relationships below the following thresholds will not be considered material relationships that impair a director’sdirector's independence: (i)(1) if a NIKE director or immediate family member is an executive officer of another company that does business with NIKE and the annual sales to, or purchases from, NIKE are less than one percent of the annual revenues of the other company; and (ii)(2) if a NIKE director or immediate family member serves as an officer, director, or trustee of a charitable organization, and NIKE’sNIKE's contributions to the organization are less than one percent of that organization’sorganization's total annual charitable receipts. After applying this categorical standard and the applicable NYSE independence standards, the Board has determined that the following directors who served during fiscal 2020 — 2023 and/or will stand for election to the Board at the Annual Meeting—Cathleen A. Benko, Elizabeth J. Comstock, John G. Connors, Timothy D. Cook, Thasunda B. Duckett, Mónica Gil, Alan B. Graf, Jr., Maria Henry, Peter B. Henry, John C. Lechleiter, Michelle A. Peluso, and John W. Rogers, Jr. — , and Robert Swan—have no material relationship with the Company and, therefore, are independent. Messrs. John J. Donahoe II, Travis A. Knight, and Mark G. Parker were not independent pursuant to NYSE rules. Messrs. Donahoe and Parker were not independent pursuant to NYSE rules because they were employed by the Company during fiscal 2020.2023. Mr. Knight was not independent pursuant to NYSE rules because he is the son of NIKE’sNIKE's co-founder and former Chairman of the Board, Mr. Philip H. Knight, who received compensation in excess of the

threshold set forth in applicable NYSE rules (the "NYSE threshold") for his position as Chairman Emeritus. The compensation paid to Mr. Philip H. Knight is described in the section below titled "Stock Ownership Information—Transactions with Related Persons". Mr. John R. Thompson, Jr., former head basketball coach at Georgetown University, was determined to be independent from September 1, 2019 until his retirement from the Board on May 31, 2020. Effective June 1, 2020, the Company and Mr. Thompson entered into a consulting agreement the terms of which are described in the section below titled "Stock Ownership"Additional Information—Transactions with Related Persons".

BOARD STRUCTURE AND RESPONSIBILITIES

The Board is currently composed of nineten independent directors and three directors who are not independent under the NYSE listing rules. During fiscal 2020,2023, there were sixfour meetings of the Board and all of our currently serving directors attended at least 75 percent of the total number of meetings of the Board and committees on which he or she served. Mr. Thompson attended less than 75 percent of such meetings. The Company encourages all directors to attend each annual meeting of shareholders. Withshareholders, and all the exception of Mr. Thompson, all directors serving at the time of the 2019 annual meetingthen standing for election attended the 20192022 annual meeting.

BOARD LEADERSHIP STRUCTURE

Given the particular experience and tenure of Messrs. Parker and Donahoe, the Board believes this leadership structure is appropriate for the Company because it separates the leadership of the Board from the duties of day-to-day leadership of the Company. This structure permits Mr. Donahoe to primarily focus his time and attention on the business, while Mr. Parker directs his attention to the broad strategic issues considered by the Board of Directors. This structure works particularly well given the talent, experience and professional relationship of Messrs. Donahoe and Parker established during Mr. Donahoe's service on the Board beginning in 2014.

In 2016, the Corporate Responsibility, Sustainability & Governance Committee established the position of lead independent director to ensure strong independent leadership of the Board. The position of Lead Independent Director is entrusted to execute the following functions:

•serve as a liaison between the Chairman, CEO,Chair and the independent directors;

•approve the meeting agendas for the Board;

•advise the Chairman and CEOChair regarding the sufficiency, quality, quantity, and timeliness of information provided to the Board;

•ensure that meeting schedules permit sufficient time for discussion of all agenda items;

•provide consultation and direct communication with major shareholders, if requested;

•preside at meetings of the Board at which the ChairmanChair is not present, including executive sessions; and

•perform other duties specified in the Lead Independent Director Charter.

In June 2019,2022, the Board re-appointed Mr. TimTimothy Cook to serve as Lead Independent Director for a term of three years. Mr. Cook will continuecontinues to serve as Lead Independent Director of the Company working in collaboration with Messrs. Parker and Donahoe.

The chairs of Board committees also play an active role in the leadership structure of the Board. The Corporate Responsibility, Sustainability & Governance Committee and the Board endeavor to select independent committee chairs who will provide strong leadership to guide the important work of the Board committees. Committee chairs work with the Company’sCompany's senior executives to ensure the committees are discussing the key strategic risks and opportunities of the Company. In the absence of the Lead Independent Director, a presiding director is appointed to chair executive sessions of non-management directors (consisting of all directors other than Messrs. Parker and Donahoe). The position of presiding director is rotated among the chairs of the various Board committees, other than the Executive Committee. Executive sessions are regularly scheduled and held at least once each year.

Mr. Philip H. Knight, co-founder and former Chairman of the Company, serves as Chairman Emeritus, with a standing invitation to attend meetings of the Board and its committees as a non-voting observer. Mr. John R. Thompson, Jr., former Georgetown University basketball coach and Board member, serves as Director Emeritus, and has a standing invitation to attend meetings of

For all of these reasons, the Board believes this leadership structure is optimal.

21 NIKE, INC.

BOARD COMMITTEES

The Board’sBoard's current standing committees are an Audit & Finance Committee; a Compensation Committee; a Corporate Responsibility, Sustainability & Governance Committee; and an Executive Committee. The Board may appoint other committees from time to time. Each standing committee has a written charter and all such charters, as well as the Company’sCompany's corporate governance guidelines, are available at the Company’sCompany's corporate website, http://investors.nike.com, and will be provided in print to any shareholder who submits a request in writing to NIKE Investor Relations, One Bowerman Drive, Beaverton, Oregon 97005-6453.

AUDIT & FINANCE COMMITTEE

MEMBERS*: Alan Maria Henry Peter Henry Robert Swan MEETINGS IN FY | ROLES AND RESPONSIBILITIES: The Audit & Finance Committee provides assistance to the Board in fulfilling its legal and fiduciary obligations with respect to: •Matters involving the •Overseeing the Company's financial policies and activities; •Matters involving information security (including risks related to cyber security) •The integrity of the Company's financial •The •The independent •The Company's risk assessment and risk management processes and practices; and •Considering long-term financing options, long-range tax, financial regulatory and foreign currency issues facing the Company, and The Board has determined that each member of the Audit & Finance Committee meets all independence and financial literacy requirements applicable to audit committees under the NYSE listing standards and applicable regulations adopted by the U.S. Securities and Exchange Commission (the "SEC"). The Board has also determined that each of Mr. | ||||

* Ms. Cathleen Benko served on the Audit & Finance Committee until October 6, 2022. Mr. Robert Swan and Ms. Maria Henry were appointed to the Audit & Finance Committee effective October 7, 2022 and June 1, 2023, respectively.

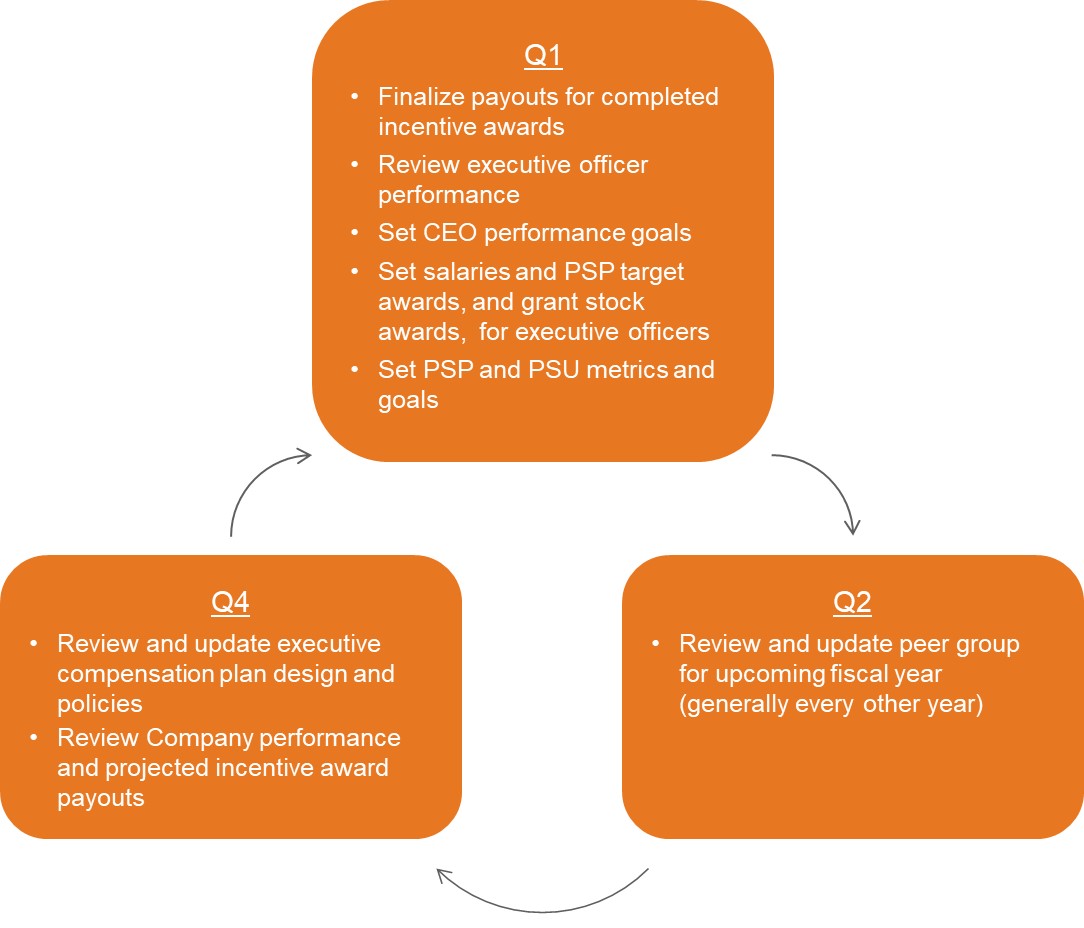

COMPENSATION COMMITTEE

MEMBERS*: Cathleen Timothy Mónica Gil MEETINGS IN FY | ROLES AND RESPONSIBILITIES: The Compensation Committee discharges the Board's responsibilities regarding executive and director compensation and senior leadership succession, and its duties include the following: •Evaluate the performance of the CEO; •Review and approve the compensation of each executive officer; •Grant equity incentive awards under the NIKE, Inc. Stock Incentive Plan, and determine targets and awards under the NIKE, Inc. Executive Performance Sharing Plan and the NIKE, Inc. Long-Term Incentive Plan; •Review and provide guidance to management regarding Company policies, programs, and practices related to talent management and development for executive officers and senior management; and •Make recommendations to the Board regarding the compensation of directors. The Board has determined that each member of the Compensation Committee meets all independence requirements applicable to compensation committees under the NYSE listing standards. | ||||

* Ms. Elizabeth Comstock served on the Compensation Committee until her retirement from the Board on September 20, 2022. Ms. Mónica Gil was appointed to the Compensation Committee effective September 20, 2022.

CORPORATE RESPONSIBILITY, SUSTAINABILITY & GOVERNANCE COMMITTEE

MEMBERS: Thasunda Duckett Michelle John MEETINGS IN FY | ROLES AND RESPONSIBILITIES: The Corporate Responsibility, Sustainability & Governance Committee sets the tone and pace for corporate governance and oversees our Purpose to move the •Review and evaluate •Provide oversight of •Monitor the •Review and evaluate the social, political, and environmental impact, trends, and issues in connection with the •Provide oversight of the •Review transactions with related persons in accordance with the Company's policies; •Oversee protection of the •Continue to identify individuals qualified to become Board members and recommend director nominees for election at each annual shareholder meeting; • •Oversee the annual self-evaluations of the Board and its committees and make recommendations to the Board concerning the structure and membership of the The Board has determined that each member of the Corporate Responsibility, Sustainability & Governance Committee meets all independence requirements applicable to nominating/corporate governance committees under the NYSE listing standards. | ||||

EXECUTIVE COMMITTEE

MEMBERS: John Travis Mark MEETINGS IN FY | ROLES AND RESPONSIBILITIES: The Executive Committee is authorized to act on behalf of the Board on all corporate actions for which applicable law does not require participation by the full Board. •In practice, the Executive Committee acts in place of the full Board only when emergency issues or scheduling conflicts make it difficult or impracticable to assemble the full Board. •All actions taken by the Executive Committee must be reported at the next Board meeting, or as soon thereafter as practicable. The Executive Committee held | ||||

THE BOARD’S ROLE IN RISK OVERSIGHT

While the Company’sCompany's management team is responsible for day-to-day management of the various risks facing the Company, the Board takes an active role in the oversight of the management of critical business risks. The Board does not view risk in isolation. Risks are considered in virtually every business decision and as part of NIKE’sNIKE's business strategy. The Board recognizes it is neither possible nor prudent to eliminate all risk. Purposeful and appropriate risk-taking is essential for the Company to be competitive on a global basis and to achieve its strategic objectives.

| THE BOARD OF DIRECTORS | ||

| The Board implements its risk oversight function both as a whole and through committees, which play a significant role in carrying out risk oversight. While the Audit & Finance Committee is responsible for oversight of | ||

| BOARD COMMITTEES | ||

The AUDIT & FINANCE COMMITTEE oversees risks related to the | ||

The COMPENSATION COMMITTEE oversees risks associated with the | ||

The CORPORATE RESPONSIBILITY, SUSTAINABILITY & GOVERNANCE COMMITTEE oversees risks associated with corporate social purpose and company governance, including | ||

| EXECUTIVE LEADERSHIP TEAM | ||

| Each committee chair works with one or more senior executives assigned to assist the committee in: developing agendas for the year and for each meeting, paying particular attention to areas of business risk identified by management, Board members, internal and external auditors, and in their committee charter; and scheduling agenda topics, presentations, and discussions regarding business risks within their area of responsibility. At meetings, the committees discuss areas of business risk, the potential impact, and | ||

The Company believes its leadership structure, discussed in detail above, supports the risk oversight function of the Board. Strong directors chair the various committees involved in risk oversight, there is open communication between management and directors, and all directors are involved in the risk oversight function.

THE BOARD’S ROLE IN ESG OVERSIGHT

The Board takes an active role overseeing NIKE's commitment to, and progress on, environmental, social, and governance ("ESG") matters. The Board oversees ESG matters primarily through the Corporate Responsibility, Sustainability & Governance

Committee. In addition to overseeing corporate governance (generally, the "G" in "ESG"), this committee also oversees the risks and opportunities associated with NIKE's Purpose to move the world forward through the power of sport, with a focus on the three pillars of people, planet, and play (generally, the "E" and "S" in "ESG"). The committee's responsibilities include reviewing and providing guidance to management regarding significant Purpose strategies, activities, policies, investments, and programs; reviewing the development of NIKE's five-year Purpose targets and long-term sustainability targets, and monitoring the Company's progress towards those targets; and reviewing and providing guidance to management regarding NIKE's annual Impact Report, which describes our progress towards our Purpose targets for our shareholders and other stakeholders. The Compensation Committee also plays a key role with respect to ESG by overseeing talent management and development for executive officers and senior management, including with respect to employee engagement and workplace diversity, equity, and inclusion. More information about Purpose, including NIKE's annual Impact Report, is available on the Impact section of our website.

| SHAREHOLDER COMMUNICATIONS WITH DIRECTORS | ||

| Shareholders or interested parties desiring to communicate directly with the Board | ||

CODE OF CONDUCT

The NIKE Code of Conduct which was refreshed in 2019, is available at the Company’sCompany's corporate website, http://investors.nike.com, and will be provided in print without charge to any shareholder who submits a request in writing to NIKE Investor Relations, One Bowerman Drive, Beaverton, Oregon 97005-6453. The Code of Conduct applies to all of the Company’sCompany's employees and directors, including our CEO and all other executive officers. The Code of Conduct provides that any waiver of the Code of Conduct for executive officers or directors may be made only by the Board or a committee of the Board. Any such waiver will be publicly disclosed, when required by law. The Company plans to disclose amendments to, and waivers from, the Code of Conduct on the Company’sCompany's corporate website: http://investors.nike.com.

CAPITAL STRUCTURE

Since NIKE's initial public offering in 1980, the Company's articles of incorporation have provided for NIKE to have two classes of voting stock, consisting of the Class A Stock and the Class B Stock.

RIGHTS AND HOLDERS OF COMMON STOCK

The shares of Class A Stock and Class B Stock have identical voting and economic rights except that the holders of the Class A Stock and Class B Stock vote as separate classes for purposes of electing directors. As long as the number of outstanding shares of Class B Stock is between 25% and 87.5% of the total number of outstanding shares of Common Stock (as is currently the case), the holders of the Class B Stock, voting as a separate class, have the right to elect 25% of the Board (rounded up to the nearest whole number) and the holders of the Class A Stock, voting as a separate class, have the right to elect the remaining directors. If at any time the outstanding number of shares of Class A Stock is less than 12.5% of the total number of outstanding shares of Common Stock, then the Class B Stock, voting as a separate class, will continue to have the right to elect 25% of the Board (rounded up to the nearest whole number), and the Class A Stock and Class B Stock will vote together as a single class to elect the remaining directors.

Because there are currently thirteen directors on the Board and the outstanding number of shares of Class B Stock is between 25% and 87.5% of the outstanding shares of Common Stock, the holders of the Class B Stock are entitled to elect four directors at the Annual Meeting and the holders of the Class A Stock are entitled to elect the remaining nine. On all other matters besides the election of directors (including Proposals 2, 3, 4, 5, and 6), the Class A Stock and Class B Stock vote together as a single class, each with one vote per share.

25 NIKE, INC.

Each share of Class A Stock is convertible into one share of Class B Stock. Such conversion is solely at the option of the holder, and cannot be dictated by either the Company or the Board. The Class A Stock is currently primarily held by Swoosh, LLC, an entity that was formed by Mr. Philip Knight, NIKE's co-founder, in 2015 to hold the majority of his shares of Class A Stock.

For additional information regarding NIKE's classes of Common Stock, see the description of the Company's securities included as Exhibit 4.7 to NIKE's Annual Report on Form 10-K for fiscal 2023. For additional information regarding key holders of the Class A Stock and Class B Stock, see the section below titled "Stock Ownership Information—Stock Holdings of Certain Owners and Management".

STRUCTURAL ADVANTAGES

Our unique capital structure enables NIKE to focus on long-term strategy, which our Board believes is critical to creating long-term value. This long-term vision has enabled the Company to prioritize research and development and innovation, to invest in transformations in support of our strategic objectives, and to integrate Purpose into our business strategy. It has also helped to preserve and advance NIKE's unique culture, which we believe powers our success.

At the same time, our capital structure meaningfully protects and represents the interests of our public Class B shareholders. All of our directors, regardless of which class of Common Stock elected them, have fiduciary duties to act in the best interests of all NIKE shareholders. In addition, all directors are subject to the same nomination and evaluation processes, which are described in the section above titled "NIKE, Inc. Board of Directors—Director Nominations", and the Board considers all directors when assessing the mixture of experience, attributes, and skills represented on the Board. All of the directors elected by our Class B shareholders, as well as six out of nine of the directors elected by our Class A shareholders, are independent, and only independent directors sit on the Audit & Finance Committee, the Compensation Committee, and the Corporate Responsibility, Sustainability & Governance Committee.

INVESTOR FEEDBACK

Although the Board cannot change or eliminate our dual class capital structure without the approval of the holders of the Class A Stock, the Company believes it is important to engage regularly with Class B shareholders to understand their views on NIKE's capital structure. The majority of shareholders with whom we engaged since our last annual meeting expressed that they did not have concerns with the Company's dual class structure in light of the fact that it provides for equal voting and economic rights on all matters other than the election of directors, as well as the Company's long history of strong corporate governance practices, effective Board composition, and extensive shareholder engagement. However, some shareholders expressed a desire for the slate of Class B director nominees to include a member from each of the key Board committees and to be refreshed more frequently. In response to that feedback, the Company's Class B slate was updated for this Annual Meeting to include a balance of continuing and new Class B director nominees and to include a member of each of the three key Board committees: the Audit & Finance Committee, the Compensation Committee, and the Corporate Responsibility, Sustainability & Governance Committee.

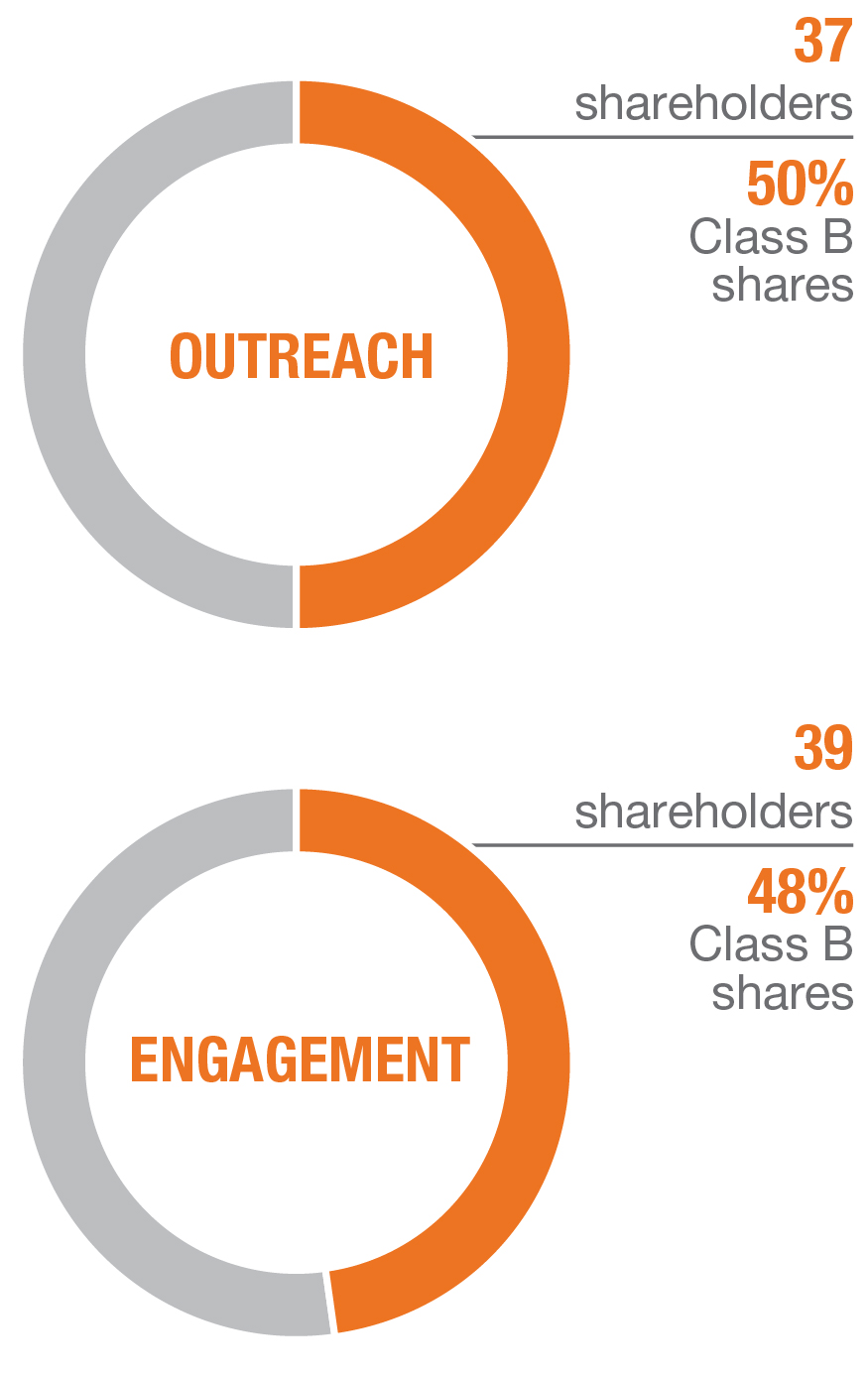

SHAREHOLDER ENGAGEMENT

Our approach to governance is informed by the insights and perspectives of our Class B shareholders. We greatly value the opportunity to engage with and solicit feedback from our shareholders regarding matters involving the Company, with a focus on ESG matters, and we believe that maintaining an open dialogue strengthens the Company's approach to its corporate governance practices and disclosures. Below is an overview of the Company's fiscal 2023 engagement practices regarding ESG matters. These ESG-related engagements take place in addition to regular financial-related outreach led by our Investor Relations team and engagement with shareholder proponents led by our Office of the Corporate Secretary.

| INTEGRATED ENGAGEMENT TEAM | TYPES OF ENGAGEMENT | KEY FY23 ENGAGEMENT TOPICS | ||||||||||||

•Independent Directors •Investor Relations •Total Rewards and Executive Compensation •Office of the Corporate Secretary •Sustainability •Responsible Supply Chain | •One-on-one meetings •Small group calls •E-mail communications | •Board composition •Risk oversight •Capital structure •Executive compensation •Purpose strategy •Responsible sourcing •Environmental sustainability •Diversity, equity, and inclusion | ||||||||||||

In fiscal 2023, we engaged with shareholders representing 52% of our Class B shares | ||||||||||||||

2023 PROXY STATEMENT 26

The Board is committed to understanding the views of our shareholders. Therefore, independent members of our Board—consisting of the Chair of our Corporate Responsibility, Sustainability & Governance Committee as well as our Lead Independent Director and Chair of our Compensation Committee—actively participated in engagements with certain of the Company's largest investors during fiscal 2023. In addition, management and our Board leadership ensures that key themes and feedback that emerge during these engagements are reported back to the full Board and any relevant committees, so that we can continue to refine and adapt our practices to better address the issues that our shareholders raise with us.

The Board and management carefully consider and integrate shareholder feedback into the Company's practices and disclosures. Recent changes to our practices include refreshing the slate of Class B director nominees for this Annual Meeting (as described in the section above titled "Capital Structure—Investor Feedback"); refining our fiscal 2023 executive compensation program, including by increasing the proportion of the long-term incentive mix delivered in the form of performance-based restricted stock units (as described in the section below titled "Executive Compensation—Compensation Discussion and Analysis—Executive Summary—Say-on-Pay Results and Response"); and revising the NIKE, Inc. Policy on Public Policy and Political Activities in fiscal 2022 to increase transparency regarding political contributions. We have also enhanced our proxy statement disclosures over the past several years in response to shareholder feedback, including providing additional detail and transparency regarding Board diversity, Board oversight of ESG, and our capital structure.

DIRECTOR COMPENSATION FOR FISCAL 20202023

NAME(1) | FEES EARNED OR PAID IN CASH ($) | STOCK AWARDS(2)(3) ($) | CHANGE IN PENSION VALUE AND NONQUALIFIED DEFERRED COMPENSATION EARNINGS ($) | ALL OTHER COMPENSATION(4) ($) | TOTAL ($) | ||||||||||||

Cathleen Benko(5) | 101,745 | 200,190 | — | 19,995 | 321,890 | ||||||||||||

Elizabeth Comstock(6) | 27,473 | — | — | — | 27,473 | ||||||||||||

| Timothy Cook | 165,000 | 200,190 | — | — | 365,190 | ||||||||||||

| Thasunda Duckett | 100,000 | 200,190 | — | 20,000 | 320,190 | ||||||||||||

Mónica Gil(7) | 69,780 | 190,092 | — | — | 259,872 | ||||||||||||

| Alan Graf, Jr. | 135,000 | 200,190 | — | — | 335,190 | ||||||||||||

| Peter Henry | 105,000 | 200,190 | — | 12,500 | 317,690 | ||||||||||||

| Travis Knight | 100,000 | 200,190 | — | — | 300,190 | ||||||||||||

| Michelle Peluso | 125,000 | 200,190 | — | 97,140 | 422,330 | ||||||||||||

| John Rogers, Jr. | 100,000 | 200,190 | — | — | 300,190 | ||||||||||||

Robert Swan(7)(8) | 73,035 | 190,092 | — | 20,000 | 283,127 | ||||||||||||

| NAME | FEES EARNED OR PAID IN CASH ($) | STOCK AWARDS(1)(2) ($) | CHANGE IN PENSION VALUE AND NONQUALIFIED DEFERRED COMPENSATION EARNINGS ($) | ALL OTHER COMPENSATION(3) ($) | TOTAL ($) | ||||

| Cathleen A. Benko | 100,000 | 175,049 | — | 20,000 | 295,049 | ||||

| Elizabeth J. Comstock | 100,000 | 175,049 | — | 20,000 | 295,049 | ||||

| John G. Connors | 105,000 | 175,049 | — | 20,000 | 300,049 | ||||

| Timothy D. Cook | 150,000 | 175,049 | — | 20,000 | 345,049 | ||||

| Thasunda B. Duckett | 54,670 | (4) | 175,056 | — | — | 229,726 | |||

| Alan B. Graf, Jr. | 130,000 | 175,049 | — | — | 305,049 | ||||

| Peter B. Henry | 103,118 | 175,049 | — | 5,000 | 283,167 | ||||

| Travis A. Knight | 100,000 | 175,049 | — | — | 275,049 | ||||

| John C. Lechleiter | 31,253 | (5) | — | — | 20,000 | 51,253 | |||

| Michelle A. Peluso | 118,967 | 175,049 | — | 20,000 | 314,016 | ||||

| John W. Rogers, Jr. | 100,000 | 175,049 | — | 20,000 | 295,049 | ||||

| John R. Thompson, Jr. | 82,000 | (6) | 175,049 | — | 22,536 | 279,585 | |||

(1)Does not include Maria Henry, who was appointed to the Board effective June 1, 2023.

(2)Represents the grant date fair value of restricted stock awards granted in fiscal 2023 computed in accordance with accounting guidance applicable to stock-based compensation. The grant date fair value is based on the closing market price of our Class B Stock on the grant date. As of May 31, 2023, Ms. Gil and Mr. Swan held 1,856 shares of unvested restricted stock and each other non-employee director then serving held 1,804 shares of unvested restricted stock.

(3)As of May 31, 2023, Mr. Cook held options for 14,000 shares of our Class B Stock, and no other non-employee director held outstanding options.

(4)For Ms. Peluso, consists of $20,000 in matched contributions to charities, $76,060 in security services, and the value of Company-related merchandise. For the other directors, consists of matched contributions to charities in the following amounts: Ms. Benko, $19,995; Ms. Duckett, $20,000; Mr. Henry, $12,500; and Mr. Swan $20,000.

(5)Ms. Benko served on the Audit & Finance Committee through October 6, 2022, therefore her Audit & Finance Committee annual retainer was prorated.

(6)Ms. Comstock did not stand for re-election at our 2022 annual meeting of shareholders and retired effective September 9, 2022, therefore her annual retainer was prorated.

(7)Ms. Gil and Mr. Swan were appointed to the Board on September 20, 2022, therefore their annual retainers were prorated.

(8)Mr. Swan was appointed to the Audit & Finance Committee effective October 7, 2022, therefore his Audit & Finance Committee annual retainer was prorated.

DIRECTOR FEES AND ARRANGEMENTS

Under our standard director compensation program in effect for fiscal 2020,2023, non-employee directors receive:

•An annual retainer of $100,000, paid in quarterly installments.

•Upon appointment to the Board, a one-time, sign-on restricted stock award valued at $175,000$200,000 on the date of grant, generally, the date of appointment. The one-time, sign-on restricted stock award is subject to forfeiture in the event that service as a director terminates prior to the first anniversary of the date of grant.

27 NIKE, INC.

•An annual restricted stock award valued at $175,000$200,000 on the date of grant, generally, the date of each annual meeting of shareholders. The number of restricted shares granted to each director for fiscal 2023 was determined by dividing the director's award value by the average closing price of our Class B Stock for the 20-trading day period ending on the date of grant. The annual restricted stock award is subject to forfeiture in the event that service as a director terminates prior to the earlier of the next annual meeting and the anniversarylast day of the 12th full calendar month following the date of grant.

•For the Lead Independent Director, an annual retainer of $30,000,$40,000, paid in quarterly installments.

•For chairs of Board committees (other than the Executive Committee), an annual retainer of $20,000$25,000 for each committee chaired ($25,00030,000 for the chair of the Audit & Finance Committee), paid in quarterly installments.

•For Audit & Finance Committee members, an additional annual retainer of $5,000, paid in quarterly installments.

•Payment or reimbursement of travel and other expenses incurred in attending Board meetings.

•Matching charitable contributions under the NIKE Matching Gift Program, under which directors are eligible to contribute to qualified charitable organizations and the Company provides a matching contribution to the charities in an equal amount, up to $20,000 in the aggregate, for each director annually.

STOCK OWNERSHIP GUIDELINES FOR DIRECTORS

NIKE maintains stock ownership guidelines for all non-employee directors. Under these guidelines, directors are required to hold NIKE stock valued at five times their annual cash retainer. New directors are required to attain these ownership levels within five years of their election to the Board. Each of our directors has met or is on track to meet the specified ownership level.

DIRECTOR PARTICIPATION IN DEFERRED COMPENSATION PLAN

Under our Deferred Compensation Plan, non-employee directors may elect in advance to defer up to 100 percent of the director fees paid by the Company. For a description of the plan, see the section below titled "Compensation Discussion and Analysis—"Executive Compensation—Executive Compensation Tables—Non-Qualified Deferred Compensation in Fiscal 2020—2023—Non-Qualified Deferred Compensation Plans". In addition, in fiscal 2000, Mr. Thompson received credits to a fully vested NIKE stock account under the Deferred Compensation Plan in exchange for his waiver of rights to future payments under a former non-employee director retirement program. The Class B Stock credited to Mr. Thompson’s account will be distributed to him upon termination of his service as Director Emeritus and the account is credited with quarterly dividends until distributed.

EXECUTIVE COMPENSATION

PROPOSAL 2 SHAREHOLDER ADVISORY VOTE TO APPROVE EXECUTIVE COMPENSATION | ||||||

In accordance with the requirements of Section 14A of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), we are submitting to shareholders our annual "say-on-pay proposal", an advisory vote to approve the compensation of our Named Executive Officers as described in this proxy statement. At As discussed in this section, our executive compensation program is designed to attract and retain top-tier talent and maximize shareholder value. To achieve the objectives of our executive compensation program and emphasize pay-for-performance principles, the Compensation Committee has continued to employ strong governance practices, including: • basing a majority of total compensation on performance and retention incentives; • setting • mitigating undue risk associated with compensation by using multiple performance targets, caps on potential incentive payments, and a clawback policy; and • requiring executive officers to hold NIKE stock through published stock ownership guidelines. Because your vote is advisory, it will not be binding on the Board. However, the Board values shareholder opinions, and the Compensation Committee will take into account the outcome of the vote when considering future executive compensation arrangements. | ||||||

| BOARD RECOMMENDATION | ||||||

| The Board of Directors recommends that shareholders vote FOR approval of the following resolution: RESOLVED, that the shareholders approve the fiscal | |||||

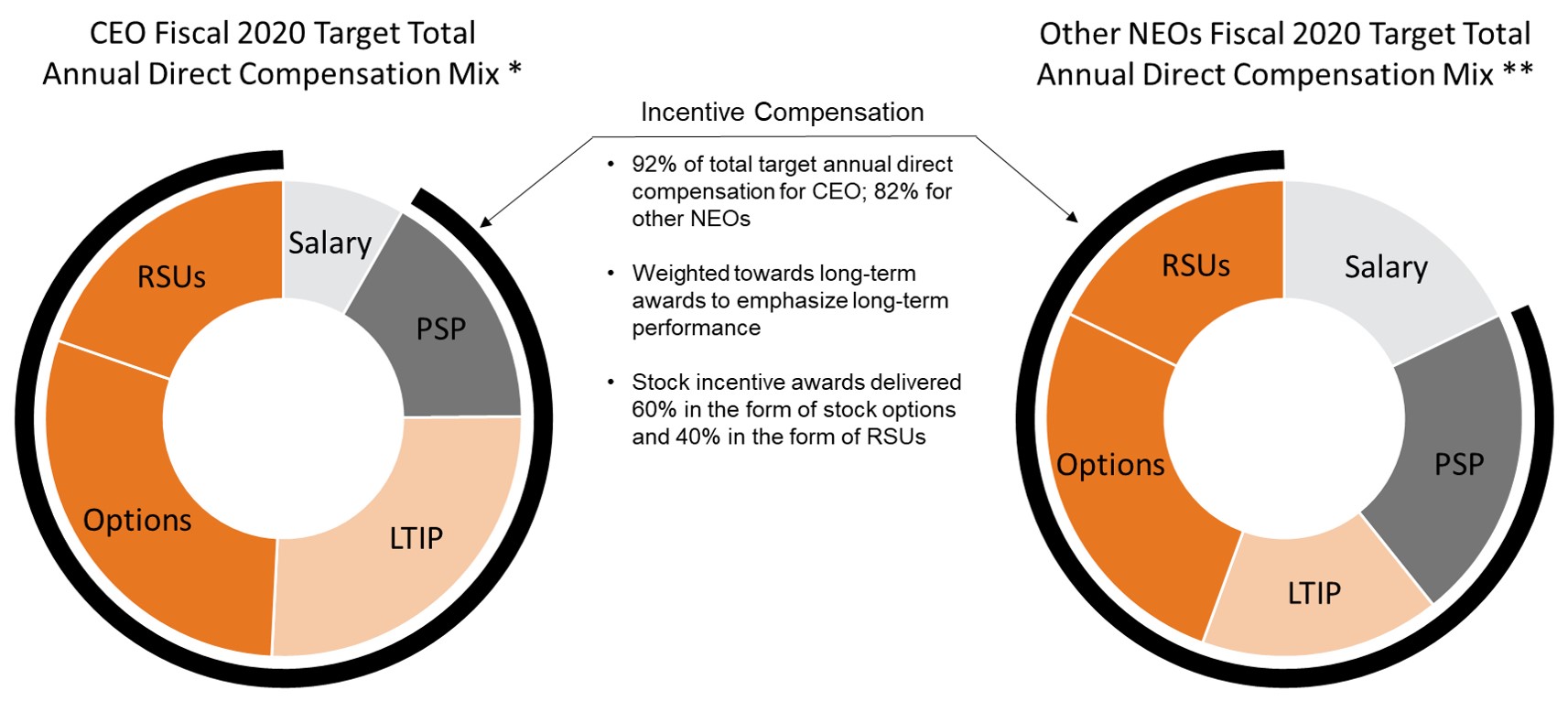

This Compensation Discussion and Analysis ("CD&A") describes our compensation program, philosophy, decisions, and process for the compensation of our "NamedNamed Executive Officers" (also referred to as our "NEOs")Officers for fiscal 2020:

2023:

| NAMED EXECUTIVE OFFICER | TITLE1 | ||||

| John | President and Chief Executive Officer | ||||

| Mark | Executive Chairman | ||||

| Matthew Friend | Executive Vice President and Chief Financial Officer | ||||

| Andrew Campion | Chief Operating Officer | ||||

| President, Consumer and Marketplace | |||||